A Corrupt System of Dependency

Last summer while my wife and I were having dinner at a local restaurant, the waitress who was serving our table asked me how everything was going with my law practice. I looked at her, hesitated, and answered, “It’s going pretty well.” Since I didn’t recognize her, I asked, “Do you work for a law firm?” She answered that she had worked at the courthouse for several years before quitting her job.

I asked why she no longer worked at the courthouse and she told me that she had young children at home and was able to make more money by quitting her full-time job. She explained that after she quit, she applied for rental assistance, food stamps, and Medicaid. She was subsequently approved for all three programs.

After being approved for government assistance, she applied for and was hired as a part-time waitress at the restaurant. She explained to me that she was now receiving more money and benefits by working part time than what she was able to bring home while she worked full time at the courthouse.

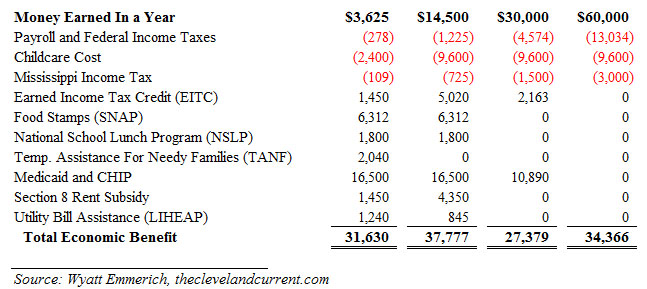

I thought about the waitress last week when I saw a chart that was included in an article that was written by Wyatt Emerich and published in The Cleveland Current. The chart includes four examples of income and benefits for a one-parent family of three in the state of Mississippi. What is most revealing about the chart is that a family with an income of $14,500 per year has more disposable income and benefits than a family that has income of $60,000 per year.

Take a look at the chart that Emerich provided in his article:

The first row of numbers that are shown in parentheses reflects the amount of federal taxes that are paid for the level of income that is listed in the corresponding column. The next row of numbers shows the cost of childcare for each level of income, and the following row of numbers shows the amount of income taxes that are paid to the State of Mississippi.

The numbers on the chart are much more revealing with regard to the government benefits. Although the chart represents income and benefits for residents of Mississippi, I can tell you from personal experience that the same types of benefits are available for residents of Illinois.

Because I represent low-income individuals in bankruptcy court and, in some instances, personal injury cases, I routinely see benefit numbers that are similar to what is shown in the chart.

If you were the waitress and were earning $14,500 in annual wages, would you be willing to work twice as many hours each week to increase your earnings to $30,000 per year? If you did do that, according to the chart, you would experience a reduction in net disposable income and benefits of more than $10,000 per year.

One additional factor to consider concerning the waitress is that if she does not report her tips on her state and federal income tax returns, in addition to receiving all the benefits shown in the chart, she also reaps an additional windfall by keeping the taxes she would have had to otherwise pay on her unreported income.

What you see in the chart is a classic example of what is commonly referred to as “redistribution of wealth.” But is it really wealth that is being redistributed? The word “wealth” is defined as an “abundance of valuable material possessions or resources.” Do you think gross income of $60,000 falls within the definition of wealth, especially in light of the fact that $16,034 is taken in taxes and another $9,600 is spent by the wage earner for childcare expenses?

What is really going on here is forced redistribution of income that is received by a person who would normally be defined as a member of the upper middle class. Yet, as you can see, an “upper middle class” person makes less in net disposable income and benefits than a low-income person.

What I told you about the waitress, which is verified by what you see in the chart, is a dangerous trend that is taking place in our country. What incentive does a person have to obtain the education and skills that are necessary to generate an “upper class income” of $60,000 per year, when he or she can earn more in disposable income and benefits by only working part time?

The taxes that are used to pay the generous benefits to low income individuals come primarily from the rapidly shrinking upper middle class. Unfortunately, the upper middle class is being wiped out in this country because of (1) a lack of good-paying jobs, and (2) incentives that are in place for them to not want to invest the time and energy that is necessary to generate more income — income that will be confiscated by the government to pay to people who earn less than they do.

There is going to come a time in the not-too-distant future when there will not be enough tax dollars from upper middle class earners to redistribute to low income earners. What are we going to do then, create more digital money out of thin air? If you think that we can make up the difference by raising the taxes on rich people, you’re mistaken. There are simply not enough “one percenters” (millionaires and billionaires) who can be taxed to make up the difference.

This is what happens to a nation when it decides that it no longer has any use for God. The economic and financial system gets turned upside down by corrupt leaders who only care about buying votes. Eventually, everyone suffers as a result of the massively corrupt system.

By the way, I have no resentment toward the waitress. She has the legal right to maximize the amount of benefits that are available to her and her family. She is doing what any normal person would do — looking out for her own self-interests and the needs of her family. I do, however, deeply resent the politicians who, over the past 50 years, intentionally and methodically built the system of dependency that is now embedded within our economy.

1 Comment

DEAR GEORGETTE AND HARRY –

UNDERSTANDABLY, MY HEAD WAS SPINNING AFTER READING THE CHART AND YOUR EXPERIENCE WITH THE WAITRESS! NOT THE MATH PART – I’VE TAUGHT MATH AND FOUND IT DELIGHTFUL. IT’S THE POLITICS THAT GETS IN MY WAY OF UNDERSTANDING! YOU’RE SO RIGHT IN SAYING GOD HAS BEEN LEFT OUT!

ALL I CAN DO IS THANK GOD THAT I’M 87 AND HAVE THE ABILITY TO PRAY ABOUT SUCH. A VERY GOOD ARTICLE, ONCE AGAIN! THANK YOU, WITH LOVE.

SISTER ROBERTA